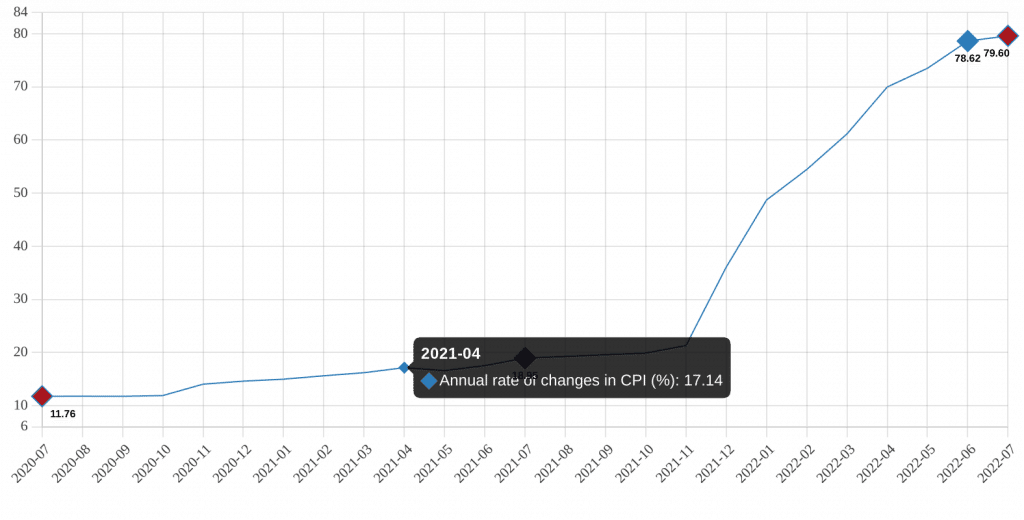

Turkish inflation keeps soaring as the latest data announced by the Turkish Statistical Institute (TÜİK) indicate a 79,6 percent annual rise in the Consumer Price Index and 144,6 percent rise in the Producer Price Index. The number is the highest inflation recorded in Türkiye in 24 years since 1998.

According to TÜİK a change in general index was realized in CPI (2003=100) on the previous month by 2.37 percent, on same month of the previous year by 79.60 percent and on the twelve months moving averages basis by 49.65 percent in July 2022.

However, there is a growing dispute over the veracity of the official data as some economists and critics argue that the real rate of inflation was almost double the official figure.

According to ENAGroup, established by a group of independent researchers, their calculation that is based on daily price index changes indicate a 176 percent rise in CPI.

The Istanbul Chamber of Commerce (ITO) declared consumer inflation in Istanbul as 99 percent on 1 August.

Annual rate of changes CPI July 2022 (Graphic: TÜİK)

Inflation keeps soaring to 80 percent

At the beginning of 2022, Treasury and Finance Minister Nureddin Nebati suggested that inflation would approach perhaps 50 percent in June, but then begin to decline.

According to the results of the participant survey published in July, the Central Bank (CBRT) raised its year-end inflation forecast from 64.6 to 69.9 percent, approximately 70 percent, and its US dollar forecast to 18.99, approximately 19 liras.

Türkiye’s inflation hit a 24-year high of almost 80 percent in June at 78,62. The Turkish Lira has lost almost 20 percent of its value against US Dollars this year, almost 50 in one year. The US Dollar was traded at 17, 95 TRY in the morning hours.

The Central Bank adheres to a stimulus policy keeping the policy interest rate at 14 despite the inflation to boost import-led growth.

Industrialists complains, Erdoğan asks patience

Central Bank President Şahap Kavcıoğlu accused the members of the Istanbul Chamber of Industry, who complained that they could not find loans from the banks at 40-50 percent rate, despite the policy rate being kept at 14.

He said that they were trying to reduce interest rates by taking steps.

After the cabinet meeting on August 1, President Tayyip Erdoğan asked the citizens for a little more patience.

The government cites foreign developments, such as the Ukraine-Russia war, as the reason for its inability to reduce inflation, gives an example that consumer inflation is increasing all over the world, and claims that Erdogan’s policy of “interest is the cause of inflation” has no effect on this.

Erdogan says he can fix the economic crisis with high export figures. Economist Fatih Özatay is of the opinion that the expected contraction in the European economy, which is Turkey’s main export market, may jeopardize this, and that the problem lies in the wrong economic policy.