Doubts about TUIK inflation data are the second major obstacle to the Central Bank’s possible rate cut. When it starts cutting rates and announces the inflation forecasts behind it, it will undoubtedly face significant backlash. The question will be, “Which inflation did you base the rate cut on?”

Unless the Minister of Treasury and Finance or the Governor of the Central Bank is suddenly dismissed, as it happened before, and the current ‘lacking’ economic program continues to be implemented, inflation in Türkiye could reach 40 percent by the end of 2024 and around 30 percent by mid-2025.

Even if this happens, Türkiye will remain one of the countries with the highest inflation rates in the world. For example, according to the IMF’s forecasts for the end of 2024, Iran will have the seventh-highest inflation rate in the world at 35 percent, and Nigeria will have the tenth-highest at 24 percent. We are projected to be the sixth in 2024.

Expected capital inflow

Any central bank aiming to combat inflation sets the short-term interest rate (policy rate) as its main tool to achieve this objective. While doing this, it primarily considers its inflation forecasts for the near future. For instance, how will inflation evolve if the policy rate follows a particular path over the next twelve months? Naturally, it also considers possible developments of other variables that determine inflation.

Let us enunciate about Türkiye. If there is no significant surprise, the Fed’s rate-cutting process will commence before the end of this year, while the ECB has already begun this process. If economic policy is handled correctly, more capital will flow to countries like ours (increasing foreign exchange supply). Clearly, this will put downward pressure on the exchange rate and reduce production costs, which is good news for inflation. Moreover, energy prices, which are significant for Türkiye, are not expected to rise unless there is a negative geopolitical development.

Budget deficit and interest rate cut

In the Medium Term Program, the budget deficit as a ratio of GDP is estimated to be 6.4 percent in 2024. Part of this is due to mandatory expenses related to the earthquake, whereas the other part stems from decisions made and implemented before the May 2023 election. Regardless of the reason, this is a high budget deficit. Although some tax regulations have already been made to finance earthquake expenditures, a high budget deficit remains. Further regulations need to be made to reduce the budget deficit and convince everyone that the improvement in the budget will continue in 2025. Let us assume such decisions are made and implemented.

Under these conditions, the Central Bank will likely start lowering the policy rate from autumn onwards. The policy rate is currently at 50 percent; if inflation is expected to move towards 30 percent by mid-2025, a rate of 50 percent would be high. If a rate cut is deemed risky in September, it will be considered in October.

However, decisions regarding the policy rate are not made solely on the ‘technical’ grounds I outlined above. There is also a ‘PR’ aspect. No matter how technically sound your decision is, your mission becomes challenging unless you convince the public of those technical reasons. A decision to cut interest rates could ‘backfire,’ such as leading to an unexpected jump in the exchange rate.

The Central Bank faces two obstacles

In this respect, the Central Bank has two significant obstacles: The first, easily guessed, is the recent past.

The Central Bank had rapidly cut interest rates starting from September 2021. Despite the “Turkish Statistical Institute (TUIK)’s inflation” rising from 19 percent in September 2021 to around 85 percent by 2022, it stubbornly reduced the policy rate to 9 percent.

More notably, almost everyone considers that this decision was implemented at the behest of the political authority. Although consistent with my analysis above, the President’s recent statement that a rate cut might be on the agenda in autumn might recall the past.

Therefore, the first obstacle for the Central Bank may be the inability to convince everyone that the rate decision is not taken under political pressure.

The Central Bank authority must devise a communication strategy to overcome this obstacle. Even if this is overcome, a critical second obstacle closely related to the first one remains: the doubts about the inflation figures announced by TUIK.

Doubts about TUIK’s inflation figures

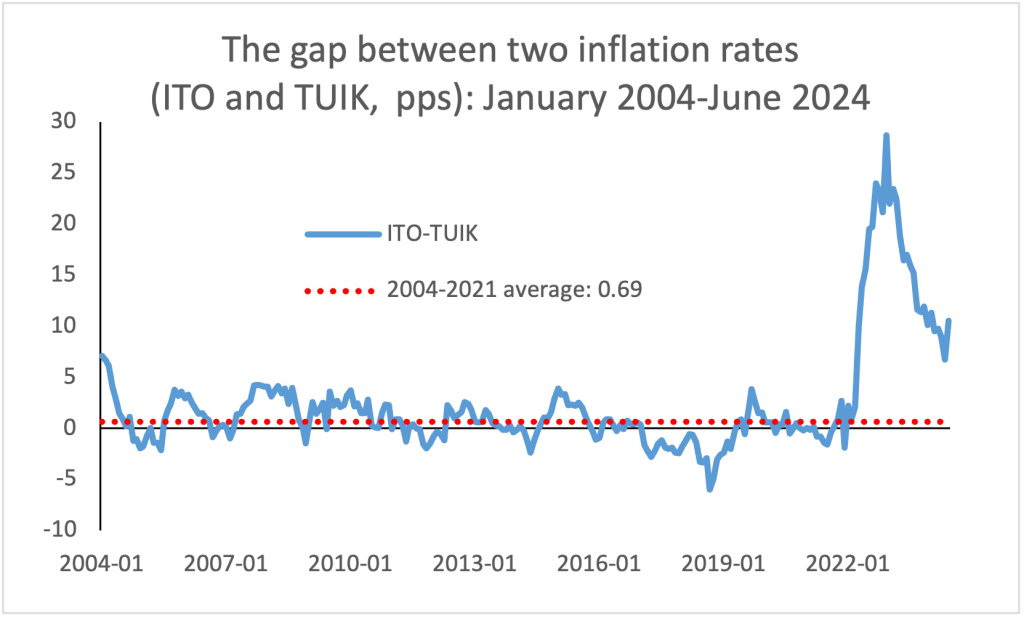

The graph displays the gap between the annual inflation measured by the Istanbul Chamber of Commerce (ITO) Istanbul Wage Earners Living Index and TUIK’s annual inflation since January 2024. The average gap between 2004 and 2021 is only 0.69 points. However, from the beginning of 2022 to the end of 2022, the gap widened and reached 28.7 points in December 2022. Then, there was a decline, though it was still high.

In a press conference on July 9, the TUIK President publicized the gap between ITO and TUIK inflations for two main reasons: First, he stated that the method used by ITO (once taken from TUIK) is now obsolete and new techniques have emerged over time.

Second, he emphasized that the ITO index is for Istanbul, while TUIK covers Türkiye. Both statements are correct; however, these differences existed in 2021 and 2019. What happened in 2022 that caused the two inflation series, which had not deviated “statistically” from each other in previous periods, to diverge sharply? The answer to this question is remarkably crucial but was not given.

Of course, it is not the TUIK President’s issue. The significant thing is trust in the announced data. Notice I did not compare TUIK inflation with ENAG inflation. That is also problematic because its method is vague. There is no satisfactory information on how those high inflations are found. The TUIK President has the right to criticize ENAG’s method of calculating rent price increases.

“Which inflation did you base the rate cut on?”

The issue is not ENAG, either. Whether we take the inflation in Northern Cyprus using the Turkish lira or the ITO inflation, there are considerable differences with TUIK, especially in 2022. These gaps are gradually narrowing in 2024. Although this positive trend was reversed in June, this is ultimately just an observation. Moreover, there is no significant difference between TUIK’s food inflation and the food inflation measured by TEPAV in June. Meanwhile, I highly recommend, for those who are interested, Ekrem Cunedioğlu’s article, “Transparency is Good for All Indices,” which compares the announced inflation indicators.

Additionally, the basket of goods used by Turk-Is to calculate the hunger threshold was well below TUIK’s food inflation in June.

Doubts about TUIK’s announced inflation data are the second major obstacle to the Central Bank’s possible rate cut. When it starts cutting rates and announces the inflation forecasts behind it, it will undoubtedly face significant backlash. The question will be, “Which inflation did you base the rate cut on?”

TUIK is highly responsible for this concern; it should not cause the policy rate to remain unnecessarily high. It must be transparent. However, this task is too critical to be left solely to TUIK. The Minister of Treasury and Finance and the Central Bank must find a solution with TUIK.

Do you see how bizarre things materialize when actions contrary to rationality are taken? Creating an environment where it is challenging to reduce interest rates when necessary is no small ‘accomplishment.’ For this reason, I have been writing for a long time that one of the fundamental deficiencies of this program needs to address the institutional structure of TUIK. Unfortunately, no one has listened so far.