The deficit and the Resource Curse

The cost of extraction and the annual potential production level of 320 billion m3 natural gas recently discovered in the Black Sea have not been clarified yet. But it’s understood that this discovery will provide a substantial resource for the Turkish economy. And upon the discovery of this natural gas resource, several studies and comments got published on its possible economic effects. I think the study titled “Why most natural resource-rich countries are poor?” by Gülçin Özkan of King’s College London, is among the most important.¹ In her article published on the online news platform T24, Özkan points to what economists describe as the “resource curse”.

Rich natural resources do not ensure economic development and growth when “good institutions” are absent. Instead, they cause economic stagnation and recession in the long run, especially by hindering the development of the manufacturing industry. Özkan emphasizes that “no matter how great the natural resource discoveries are, they do not constitute an alternative to good institutions.” “More importantly,” she adds, “without them, they turn into a curse and not a blessing”. The “Resource Curse”, or paradox of plenty, is the problem here.²

The “resource curse” is related to the institutional structure, and the institutional structure is related to the economic policies. What are the priorities of growth policies in Turkey? How can these priorities affect the relation between natural gas, current account deficit, and growth? This article will try to briefly answer these questions.

Turkish economy’s current account deficit problem

Let’s first look at the relationship between growth and the current account deficit. “Current account” includes the trade of goods and services and primary and secondary income accounts. Since the trade deficit makes up almost all of the current account deficit, we used only trade deficit data in the figures and explanations in this article.³ The importance of the current account deficit depends on the size of the economy. So its ratio to gross domestic product (GDP) is generally used as an indicator.

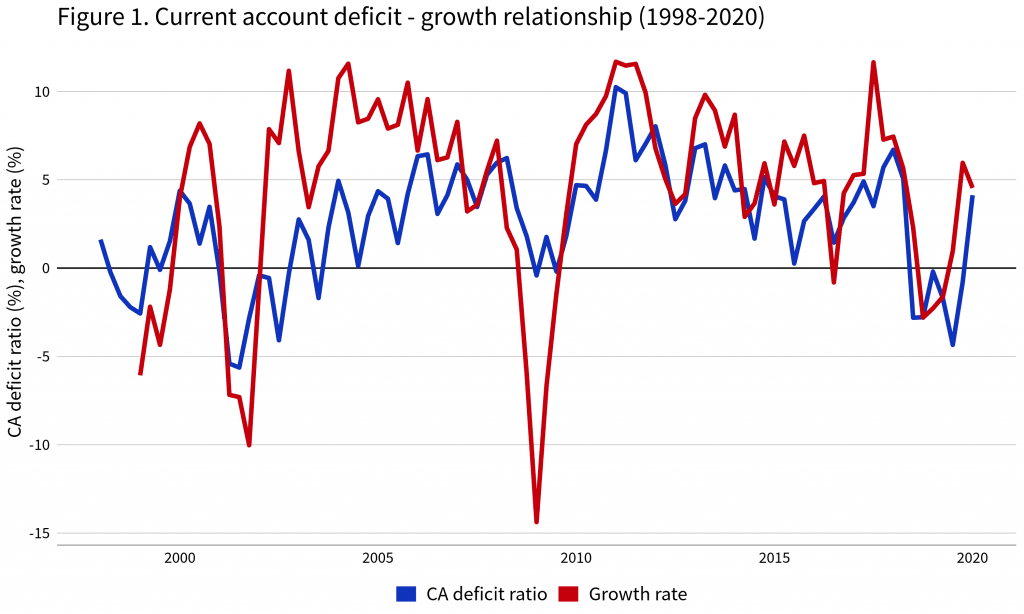

As is well known to everyone watching the Turkish economy, growth and the current account deficit have been hand in hand since 2000; the 2007-2008 global economic crisis further strengthened this bond. Fig. 1 includes the annual GDP growth rate and current account deficit ratio data.⁴ We used the import-export difference, not export-import, to better see the relationship between the two variables. As can be seen in the figure, the current account deficit increases in the period when the rate of economic growth increases. Meanwhile, imports decrease rapidly when the economy goes into recession or crisis, which reduces the current account deficit. The current account deficit-growth relation is one of the key properties of Turkey’s economy in the last 20 years.

A chronic problem

Another key property of the Turkish economy is the chronicity of the current account deficit. During the period between 1998 and 2020, shown in Fig. 1, the economy had a current account deficit almost every year. In other words, Turkey has been buying more than it sells to other countries for the last 20 years and consuming more than it produces.

The reason for that is not Turkey being an importer of energy (after all, energy is also a product). The reason is Turkey’s preferred growth policy. For example, countries like Germany, China, and Korea, are also net energy importers. But they do not have a current account deficit.

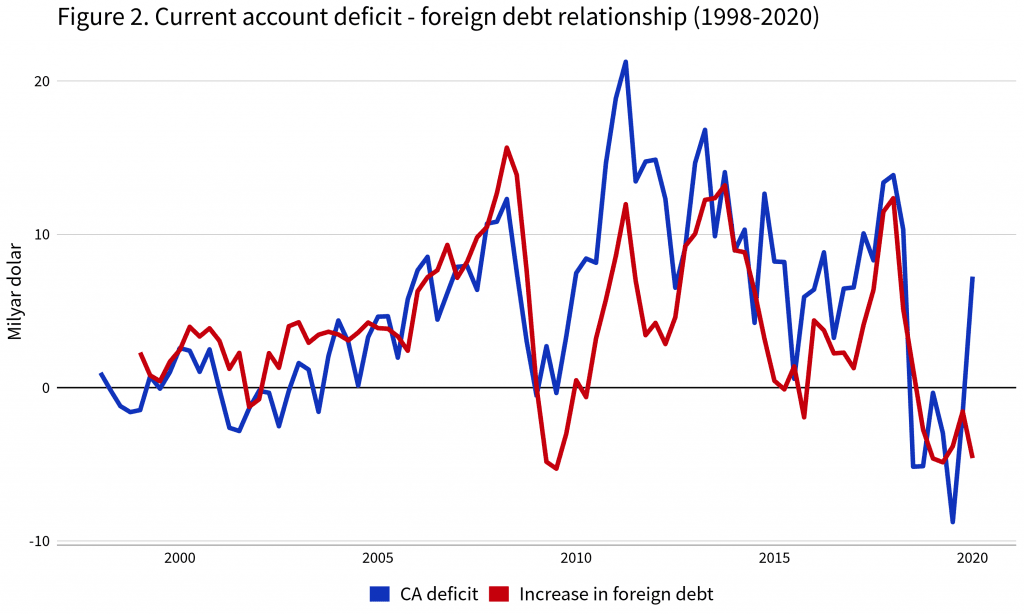

Deficit, under-production, over-consumption, external debt

Before we get to the growth policy issue, let’s look at in what ways we, in Turkey, produce less and consume more. The most important source allowing Turks to spend more than their income in Turkey is foreign debt. (Foreign direct investment and the sale of the country’s assets are other sources.) Fig. 2 shows the relationship between Turkey’s current account deficit and its foreign borrowing.⁵ As is seen, Turkey’s foreign debt increases along with its current account deficit. Turkey largely manages to make up for the current account deficit by borrowing.

To sum up, there is a close relationship between growth, current account deficit, and debt in Turkey. This relation can manifest itself in various ways. The outcome, however, stays the same: Turkey needs the current account deficit to grow and finances its deficit through borrowing. To put it in reverse, Turkey is able to grow faster when it can borrow due to its current account deficit. Therefore, Turkey’s growth performance depends on the ability to borrow, which means it is dependent on international liquidity and risk conditions. This addiction also leads to fragile growth performance.

Non-productive sectors prioritised

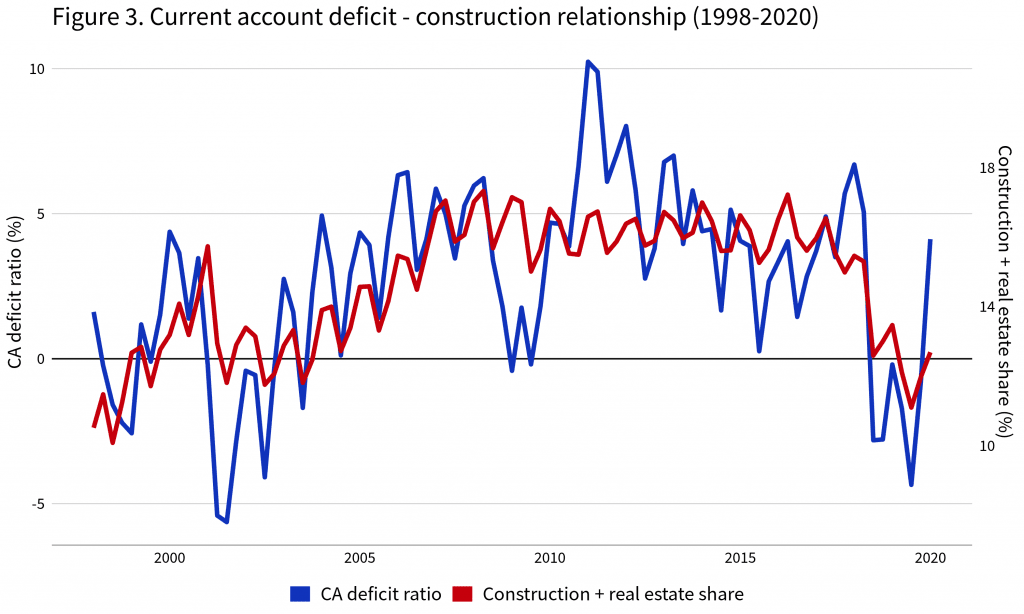

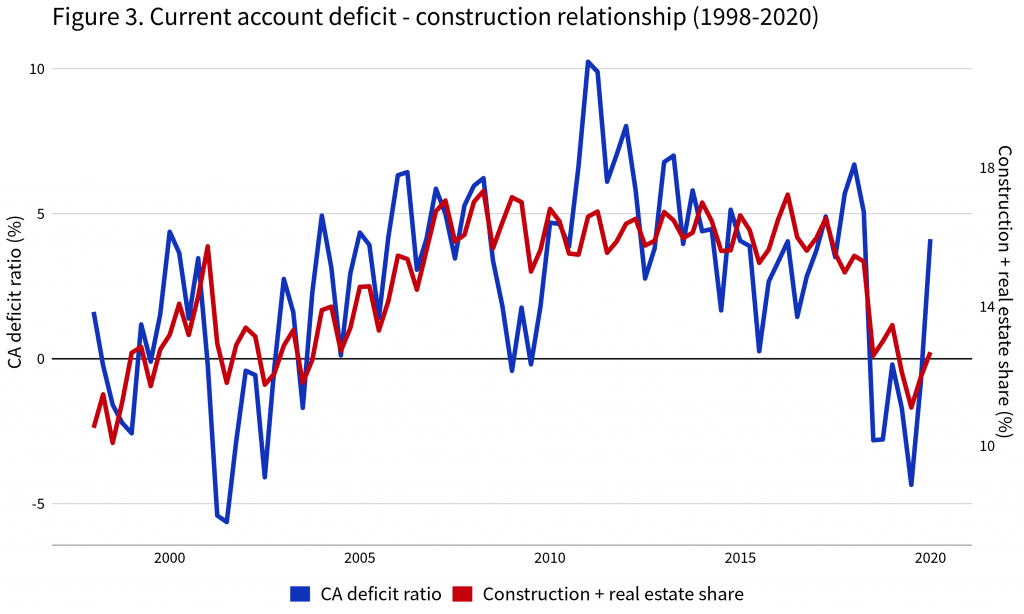

Now we can get back to the issue of growth policy. Which sector benefits the most from the current account deficit? To determine this, we can look at how the share of sectors in GDP change (at current prices). Fig. 3 shows how the share of the construction and real estate sectors in GDP has changed between 1998 and 2020. The share of the construction and real estate sectors in GDP increased in 2001-2008 along with the increase in the current account deficit. They remained more or less constant after 2009 and rapidly declined after 2018. Looking at the share of the construction and real estate sectors separately, the overall trend does not change much. The only important difference is that while the share of construction fell rapidly in the 2009 crisis, the real estate was unaffected.

The relationship between the construction and real estate sectors’ shares and the current account deficit is clear and strong. When we experience a period of current account deficit (where growth is achieved with foreign debt), the shares of the construction and real estate sectors also increases. The policy of growth through current account deficit and increasing foreign debt benefits the construction and real estate sectors (the most).

The problem isn’t lack of resources but policy

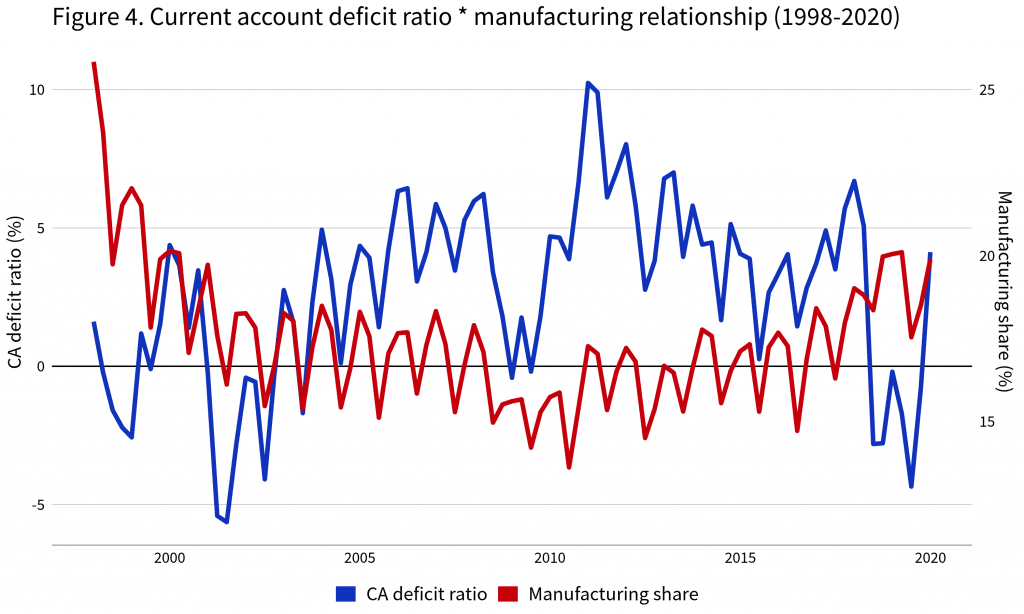

How is the state of the manufacturing industry, which plays an important role in long-term growth and productivity? Fig. 4 shows the share of the manufacturing industry in GDP and its relationship with the current account deficit. As we can see, there is a very striking negative relationship between these two variables. The share of the manufacturing industry is low in periods of increased current account deficit! Between the years 2000-2011, when the current deficit increased rapidly, the share of the manufacturing industry in GDP decreased from about 20{4a62a0b61d095f9fa64ff0aeb2e5f07472fcd403e64dbe9b2a0b309ae33c1dfd} to 15{4a62a0b61d095f9fa64ff0aeb2e5f07472fcd403e64dbe9b2a0b309ae33c1dfd}. It is increasing again after 2016.

As a result, the last 20 years saw an increase in Turkey’s growth during the times it’s experienced current account deficit and foreign debt. This growth has benefited not the manufacturing industry. Instead, it worked to the advantage of the unproductive industries of construction and real estate. Growth on the basis of foreign resources and the priority given to construction and real estate is not a result of our being rich or poor in natural resources. It’s a result of economic policy priorities.

What counts? Discovery or invention?

What impact can the discovery of natural gas resources have? At this stage, domestic gas revenue will have an impact like a foreign resource: increasing imports, declining manufacturing, and growing construction and real estate sectors. And ultimately, it will lead to the economic phenomenon of “Resource Curse,” this time in Turkey. In order not to be caught by the Resource Curse, economic policies must change. A growth policy that aims to increase productivity and wages on the basis of the manufacturing industry and productive service sectors must be adopted. Paradoxically, as is seen in many successful countries, when such a policy is implemented, the natural resources become less important. Rather than mere discovery, invention comes to the forefront.

Speaking of invention… As a final word, let us emphasize that the most important technological transformation and innovations in the world in recent years have focused on “renewable energy”. This was due to the climate crisis and the demand for fossil fuels is in a decreasing trend.⁶

- ¹Gülçin Özkan, “Doğal kaynak zengini ülkelerin çoğu neden fakir?”, T24, 26 Ağustos 2020.

- ²Here we are only dealing with economic problems. As we see every day in examples such as Libya and Iraq, the richness of natural resources can cause political-military problems and disasters.

- ³Let us emphasize that the results presented in this article do not change when current account deficit data are used.

- ⁴Here, the quarterly data were used. The growth rate was calculated relative to the same quarter of the previous year to control for seasonal effects. Current account deficit (import-export) / GDP ratio in the current period.

- ⁵Concerning the current account deficit during the 3-month period in question, the import-export deficit is measured in billion dollars. To eliminate the effect of seasonal fluctuations, “Foreign debt increase” was calculated as 1/4 of the increase in foreign debt between the relevant quarter and the same quarter of the previous year.

- ⁶I would like to thank METU faculty member Ebru Voyvoda for her valuable comments and suggestions.