In my earlier piece, I had mentioned our ongoing research that investigates the economic costs of delaying a full lockdown . In this piece, I would like to share the preliminary results from that research that explores the effects of COVID-19 on the Turkish economy and proposes policy recommendations. In addition to myself, the research team consists of Cem Çakmaklı, Sevcan Yeşiltaş, and Muhammed Ali Yıldırım from Koç University as well as Şebnem Kalemli-Özcan from the University of Maryland. Under certain assumptions, our key findings can be summarized as follows:

• The minimum damage to the economy is obtained under a country-wide full lockdown.

• When the full lockdown is delayed, it becomes harder to contain the pandemic, and thus the duration of the lockdown (and hence the economic costs) increase.

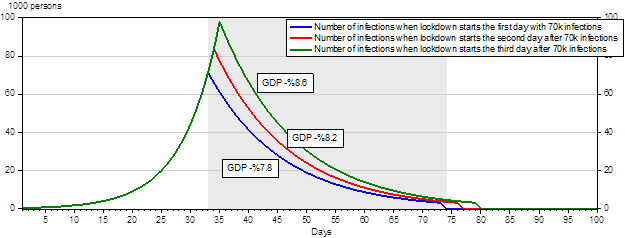

The impact of alternative lockdown scenarios on GDP is as follows:

• Under a no-lockdown scenario, as it was adopted by the UK at the early stages of the pandemic, GDP declines by 11 percent. Regardless of the economic costs, this alternative is not acceptable from a humanitarian point of view because it maximizes the number of deaths.

• Under a partial lockdown scenario similar to the status quo, GDP declines by 17 percent.

• If a full lockdown, similar to the one implemented by China, is applied today, the pandemic is contained in 38 days, and GDP declines by 7.8 percent.

If the full lockdown is delayed by one day, the pandemic can only be contained in 44 days, GDP declines by 8.2 percent.

Full lockdown and stimulus package

The above numbers should be interpreted as the approximate cost of the lockdown, which would determine the minimum size of an economic stimulus plan. Here is why:

1- Our model assumes that the companies which experience an interruption in their income streams during the lockdown survive the shock and jump back to production as soon as the lockdown is over. For this assumption to be realized, the economic units who stop production during the lockdown must be kept alive. To that end, the foregone revenues and salaries should be channeled back to the economy in the form of government transfers. This way, firms should be able to pay back their debt, and workers should be able to retain their jobs. Thus, in the event of an immediate full lockdown, economic units should be supported through a stimulus package that is about 7.8 percent of the GDP.

2- The model ignores external borrowing. The external debt that needs to be paid in 2020 is about 23 percent of Turkey’s GDP. Considering the fact that it is almost impossible to roll over this debt in the current risk-off environment, we can note that the economic stimulus package should have a TL dimension and foreign exchange dimension.

As I had mentioned in my earlier piece, the funding that is needed to contain the crisis should be provided through two channels:

• Some of the funding should be acquired through money printing as part of a well defined and targeted plan. The rest of the funding should be in the form of foreign exchange, and it should be obtained from an international institution.

•The involvement of an international institution is not only necessary to obtain external funding but also to establish credibility in a program that involves money printing. This is critical to minimize the inflationary risks of the program.

The general framework about the model

Let me now go over the model that allows us to obtain these results. The starting point of the model is the reproduction number of the virus. To estimate the economic damage, we first determine how fast the pandemic spreads and then measure its impact on the supply. In an economic model, certain assumptions need to be made. The more realistic these assumptions are, the stronger is the model. To forecast the reproduction number, we exploited the Susceptible-Infected-Recovered (SIR) model, which is also used in epidemiology. This model is widely used in the rapidly evolving COVID-19 literature to determine the speed of contagion. The key parameters of the model regarding the infection and recovery rates are calculated based on data from other countries and applied to Turkey.

In the second stage, we utilized data at the sectoral level. Using information on the amount of human contact that is necessary in each sector, we identified the speed of contagion in each sector. At this point, we estimated the decline in supply in each sector based on the number of infected patients per sector. When we calculate the reduction in supply, we not only include the number of infections, but also the number of caregivers to take care of the sick people.

In order to calculate the total impact on supply, we need to incorporate the intersectoral interaction. To that end, we use input-output tables and estimate the effect of a decline in the production in one sector that is used as the input in another sector. In this setup, we incorporated imports into the model and calculated the effects of interruptions in local supply chains that arise from a decline in imported intermediate goods.

Turning to the demand side, in order to estimate the effects of the pandemic on demand, we utilized the data on credit card purchases as a proxy for the changes in consumption habits. At the final stage, we combined the change in supply with the change in demand. As we did this, we compared the change in supply with the change in demand and assumed that the short side determines the equilibrium. For example, if supply declines by 100 units and demand declines by 50 units, we assumed that the equilibrium production declines by 100 units.

Why a full lockdown?

To reiterate one of the most important takeaways from our research: An efficiently implemented full lockdown minimizes the economic costs by containing the pandemic in the fastest way. We assume that the essential businesses remain open under full lockdown. For the lockdown to be successful, the infected people should be tracked as in South Korea. We assume that the pandemic is contained once the total number of infections declines to 3000. At this time, we assume that the number of patients can be tracked effectively, and life can return to normal.

The cost of waiting is huge

Every day that the lockdown is delayed, the number of infections increases, which lengthens the duration of the lockdown and increases the economic costs. For example, if the lockdown is put into practice today, when the number of infections is around 70,000, it can be contained within 42 days, and the consequent decline in GDP is about 7.8 percent. If the lockdown is delayed by only one day, the number of infections increases by more than 10,000. In the model, we assume that the number of infections increases faster than the official statistics, which only report the tested patients. Under these circumstances, a 42-day lockdown is no longer sufficient to control the pandemic. After 100 days, the virus starts to spread again. Prematurely ending the lockdown is rather useless, and the lost production during that time does not serve a purpose. Thus, in exchange for a one-day delay, the lockdown needs to be extended by two more days, which increases the costs of the lockdown to 8.2 percent of the GDP. If there is a two-day delay, this time the duration of the lockdown increases to 46 days and the decline in GDP is 8.6 percent. Hence, every day that the lockdown is delayed, GDP declines by about an additional 0.4 percent.

The figure illustrates the costs of delay for these three scenarios under full lockdown, based on the number of infections. The blue line shows the case where full lockdown is applied immediately after the number of infections reach 70,000 (which corresponds to the 33rd day after patient zero). The shaded area shows the duration of the lockdown in this scenario. As of the 74th day, the lockdown is over. The red line shows the scenario where the lockdown is delayed by one day and the duration increases to 44 days. The green line shows the scenario where the lockdown is delayed by two days and the duration increases to 46 days.

I should highlight that the results that I described here are obtained under certain assumptions, and it is impossible to give exact numbers about the costs of the lockdown. Nevertheless, one thing is obvious: The cost of waiting increases exponentially, and funding opportunities decline proportionally.

More details about our research will be available shortly as we publish our research paper.