When COVID-19 hit our lives around these times last year, we hardly anticipated how the year would unfold. What first appeared as a deadly outbreak in China soon took over the entire world. By the time we realized that the virus would not be contained by what seemed to be an endless lockdown of a couple of weeks, we could not focus on anything else but the pandemic. At that point, my colleagues from Koç University, Cem Çakmaklı, Sevcan Yeşiltaş, and Muhammed Ali Yıldırım got together with Şebnem Kalemli Özcan from the University of Maryland to look into the economic costs of the pandemic for the Turkish economy.

The topic was academically challenging and politically imminent. A timely evaluation of the economic damage from the pandemic under alternative lockdown scenarios was critical from the perspective of decision making. At this time, we put our energy together to produce a rather rapid and yet thorough analysis for the Turkish economy. We spent long hours on virtual chat rooms to discuss the modelling framework, the rapid developments related to the pandemic and the best way to convey our findings.

The first findings

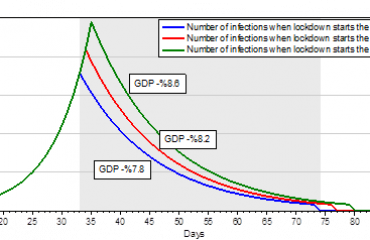

Our readers are familiar with our work that appeared in YetkinReport as early as mid-April, about 1.5 months after the pandemic hit Turkey. In that work, we highlighted that there does not need to be a trade off between saving lives vs. saving economies. To the contrary, we illustrated that an effective and strict lockdown that is implemented at the early stages of the pandemic could contain the pandemic sooner and minimize the economic drag. Thus, our policy recommendation for Turkey was an early strict lockdown for about 40 days.

An important component of demand for a small open economy like Turkey is its exports to the rest of the world. By incorporating international input-output tables, we estimated the implied changes in our exports of final and intermediate goods to the rest of the world.

Our results in the paper were driven by the demand factors relative to the suply side that was captured by a sectoral SIR model. We argued that to the extend that demand is a function of the number of infections, simply removing the lockdowns would not improve the growth prospects in the medium run. Although there might be a temporary increase in the economic activity when businesses are open, the consequent increase in the number of infections will hit demand again sometime down the road and constrain economic activity. In fact, the second wave of the pandemic that was globally observed reflected premature removal of lockdowns which brought the second wave of economic crisis. Governments considered new stimulus packages to offset the economic drag.

The second paper on vaccine distribution

Our research on Turkey revealed an interesting finding. The share of foreign demand in an emerging market like Turkey was rather sizable. This prompted another question: What would be the spillback of that effect for advanced economies? The answer to this question became particularly relevant when the news about the vaccine came out in November. By the time vaccine nationalization took over the news, the research direction that we wanted to take was rather clear in our minds: What would be the economic impact of inequitable vaccine distribution on advanced economies if they get vaccinated and their trade partners don’t? What will be the impact on their exports and imports?

In order to tackle this new and more ambitious question, we extended the framework that we had developed in our first paper to incorporate potential supply chain disruptions through imports of intermediate goods.

Once again, the developments regarding the course of the pandemic were rather uncertain where the second wave of lockdowns followed the vaccine news. In the presence of mounting uncertainties regarding the availability of the vaccine calendar or the lockdowns, we considered a short run framework where the existing supply chains prevail. We estimated the consequent decline in supply due to disruptions in supply chains.

Our framework allowed us to measure the economic costs borne by a vaccinated country that are purely due to its trade linkages with the unvaccinated countries. Specifically, vaccinated countries would observe a decline in their exports to unvaccinated countries and a decline in their imports from unvaccinated countries. The decline in imported inputs would then reduce the production of final goods in vaccinated countries.

What did we find?

We considered alternative scenarios and calculated the consequent economic costs. In a baseline scenario that we find to be more realistic, we assumed that advanced economies get inoculated within the first four months of 2021. Meanwhile emerging markets and developing economies only vaccinate half of their population by the end of 2021. Within this scenario, we considered alternative specifications. In order to isolate the impact on exports, we first shut down the supply channel and assumed that there are no disruptions in supply chains. In this specification, we found that advanced economies may need to bear close to 400 billion USD due to the decline in their exports to unvaccinated emerging markets and developing countries.

Exports are only one component of trade linkages. The amplification of the costs work through disruptions in supply chains. Our data from OECD provides information for 65 countries and 35 industries. These 35 industries group those sectors that produce similar products. Once this grouping is done, we assume there is no substitutability across the remaining broad categories of industries. If there is a supply disruption of a particular input, the overall global costs borne by the advanced economies might increase up to 1.8 trillion USD.

I should note that this is an academic work and the numbers that we provide are estimates under different scenarios and assumptions. This is why there is a wide range of estimates available given the uncertainties about the actual course of events that we try to capture with different specifications. Nevertheless, our key message remains intact.

What is the key message?

One of the most cheerful developments of 2020 was the news about the vaccine. However, the vaccine news likely generated a misperception that the countries who have immediate access to the vaccine would eliminate the economic costs of the pandemic. The consequent vaccine nationalism revealed that the production and the distribution capacity of available vaccines is far from being sufficient for the world population. When the COVAX initiative calculated the costs of producing 2 billion doses of vaccines to inoculate 20 percent of global population as 38 billion USD, merely 11 billion USD could be accumated in the fund.

The key takeaway from our analysis is the following: The advanced economies have significantly more at stake if they don’t cooperate in the COVAX facility. When we compare the costs of increasing vaccine production against the costs that will be paid in the absence of sufficient vaccination, the decision is a no brainer. It is significantly cheaper to invest in the efforts to make the vaccines globally available. It is primarily a humanitarian responsibility to produce and distribute vaccines in an equitable manner. But our results also highlight that this is not an act of charity but an act of economic rationality from the perspective of advanced economies.