A sovereign credit rating is an evaluation of a country’s creditworthiness. They can be provided at the request of a country to assess its economic and political environment. Receiving a good rating allows the countries to access funds in international markets more easily.

The rating agencies’ decisions are based on subjective evaluations and can be influenced by political factors. Nevertheless, agencies are obliged to provide accurate investment advice to maintain their reputation and preserve their market share. Improper guidance and biased investment advice cause the agencies to lose customers and profits. Meanwhile, proper guidance allows the agencies to be reliable and make money. Thus, regardless of their political inclinations, the rating agencies, which are profit-oriented corporations, are primarily motivated to produce healthy investment advice at the end of the day. After assigning a score, agencies periodically reevaluate their ratings to see if any changes are necessary.

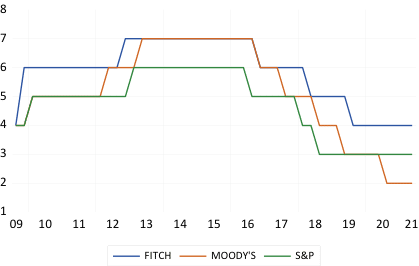

Rating agencies use similar methods in determining their credit scores. Essentially, they evaluate the ease of doing business, market dynamics and future growth prospects, and financial risks, to shed light onto how capable the borrower is in paying off the debt. Their scaling can be different. The figure below shows the path of Turkey’s credit scores from the top three agencies: Standard and Poor’s, Moody’s and Fitch.

In order to provide a visual comparison, the top 16 credit scores of each agency are assigned a numerical value from 16 (which corresponds to the top score of “AAA”) to 1 (which corresponds to B3 for Moody’s and B-for SP and Fitch). The resulting scores for Turkey are plotted from 2009 to 2021.

In this chart, number “7” corresponds to the threshold for “investment grade”. Although the agencies work independently, the chart illustrates that their ratings follow similar trends. We note that all three agencies increased Turkey’s credit ratings to their highest level in 2013, which was investment grade for Fitch and Moody’s.

Why did the rating agencies increase Turkey’s government bond ratings in the years getting into 2013, and why did they slash their ratings after 2016? When we look deeper into the reports, we note that the explanations put forth for upgrades or downgrades are strikingly similar. In particular, while the decline in external debt, institutional strength, focus on structural reforms, and budget discipline were the factors that were put forward as the drivers of the upgrade in 2013, deteriorations in many of the same factors were mentioned downgrades.

What happened after 2016?

The period after 2016 corresponds to an era when Turkey diverged further away from a semi-sustainable growth path and opted for demand-driven growth beyond its potential. During this period, Turkish inflation rate settled in two digits, productivity growth stalled, unemployment rate settled above 12 percent, and external debt increased from 47 percent to over 62 percent of the GDP. During this time, pressures over the central bank became more pronounced, and central bank credibility declined. Following the switch to the presidential system, the independence of institutions weakened further, together with elevating concerns about growth prospects.

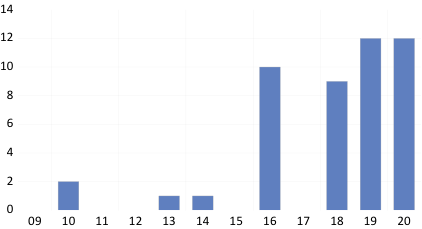

A student of mine from Koç University, Nazım Can Tilkici, took a closer look at the rating agencies’ reports to determine how many times a reference to central bank “credibility” or “independence” is made in the reports of these three agencies. Although a crude measure, this type of an analysis provides a general idea about the concerns raised by the agencies. The chart below shows the total number of references to these words from 2009 to 2020:

After 2016, there is a noticeable increase in concerns about central bank independence and credibility, except for 2017. The reports in 2017 primarily focus on political risks following the coup attempt that overshadowed the focus on central bank. In the years following 2017, however, we observe the elevated concerns regarding central bank credibility and independence, which is one reason for the downgrades during that time.

Why is central bank credibility important?

Monetary policy is one of the pillars for a stable macroeconomic environment by achieving price stability. In a country with a sizable external debt such as Turkey, price stability goes hand in hand with financial stability and external balance because price stability is one of the main drivers of capital inflows.

In order to achieve price stability, an independent and credible central bank is needed, which is determined to achieve the objectives established jointly with the government. A credible central bank can convince the public that the long-run inflation rate will be at the target so that people anchor the target rate into their decision-making process. When the central bank is not credible, however, price stability objective is harder to achieve, which weakens macroeconomic and financial stability. In our work with Cem Cakmaklı, we illustrated that the Turkish Central Bank’s control over longer-term rates declined gradually after 2006. Thus, it is no surprise that the rating agencies downgraded Turkey during this period, where the erosion of central bank credibility overlapped with a decline in overall institutional strength and meritocracy.