The Monetary Policy Committee will convene on March 17 and announce its decision. You might smirk when you read the word “decision.” As a former Central Banker, I cannot stand to write otherwise. In fact, I had had no intention to write an article for today. This morning, I sat in front of my computer for two reasons: First, Murat Yetkin’s “Will Erdoğan approve of interest rate hike?” article. Second, Argentina’s February inflation rate was announced on March 15. Let me start with Argentina first.

Growth: Argentina vs. Turkey

Whenever I make international comparisons in my lectures, I prefer to use the same set of countries to be consistent, for example, the G-20 countries. Turkey is also in this group, almost half of which are developed countries and the rest are emerging market economies.

I usually start with a word of caution for students: “Leave Argentina aside, which is always in trouble; let us compare Turkey with other countries.”

Let us look at the growth data for the 1980-2020 period. Argentina’s average growth rate is 1.6%, while Turkey’s is 4.5%. Moreover, during eighteen years of the forty-one-year period, Argentina’s economy contracted. Indeed, this country was in trouble almost halfway through this period, whereas Turkey had five contraction cases. During the 2000-2020 period, Argentina experienced economic recession disaster ten times while this number was two for Turkey. Let us narrow down the period a little more, say for the last eleven years: Argentina’s economy shrank six times in the 2010-2020 period, whereas Turkey had no contraction.

Argentina has lost the lead in inflation with the February data

The situation is not different in terms of inflation: First, there is no inflation data for the 1980-1997 period; unavailable in the IMF database. Argentina has constantly been drawn to ‘the issues’ -to put it mildly- in consumer inflation measurement on the IMF’s web page. A similar lack of information applies to the 2015-2016 period.

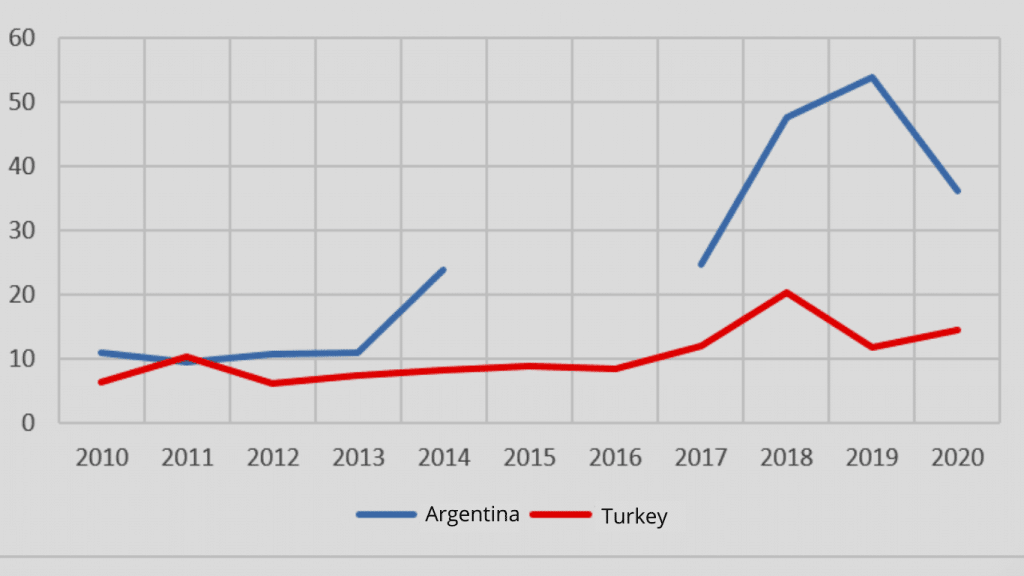

Second, there were negative inflations during the Monetary Board experience, which ended in a significant crisis. Following was a high and volatile inflationary period. Let us compare the inflation rates for the 2010-2020 period with Turkey’s rates (Graph-1). Argentina is well above Turkey in year-end consumer inflation. Argentina’s inflation is above Turkey and all emerging economies in the G-20. Argentina is a champion.

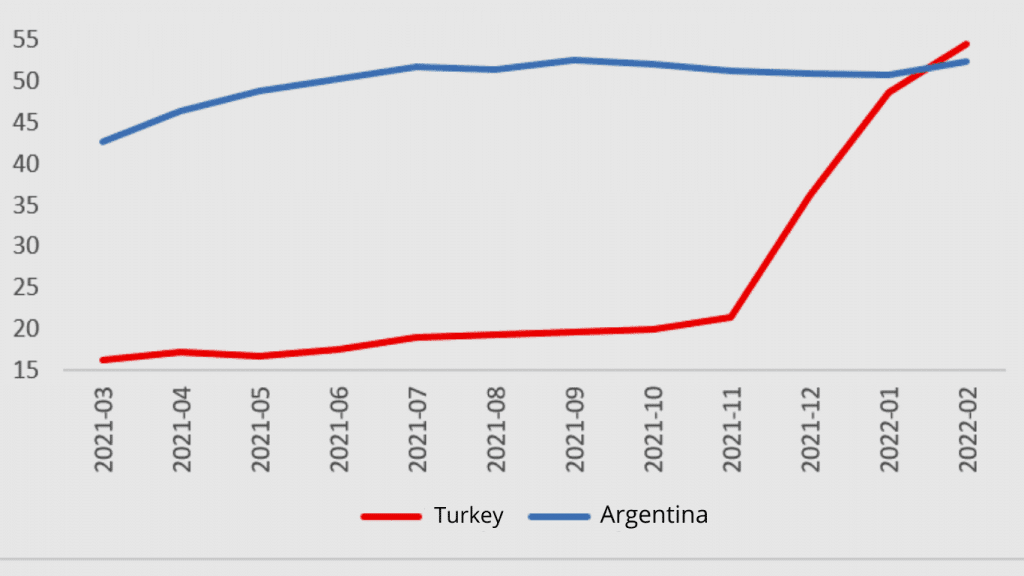

In February, Argentina lost the “leadership” to Turkey, not the “championship” as the inflation league is annual. Nonetheless, we only know the February 2022 figures yet. The consumer inflation rates of the last twelve months are shown in Graph-2. Turkey is the leader now.

Whether the leadership would turn into a championship in 2022 for Turkey brings us to Murat Yetkin’s yesterday article.

Will the Central Bank increase the interest rate?

The right question is “will there be a policy rate hike?” rather than “will there be an interest rate hike?” The policy rate is the rate that the Central Bank charges banks to lend them, generally weekly, which is currently at 14%.

People get confused unless the emphasis is on the “policy rate.” Consequently, “will the loan rates or the Treasury’s borrowing rate be increased?” could be asked. Readers familiar with the subject could object to the question. They could say: “The Central Bank Monetary Policy Committee does not determine the loan rate or the Treasury’s borrowing rate.” On the other hand, those who are much akin to the subject or those who recall the following article are aware that there is an equation like this: “lowering the policy rate while leading the inflation league is equal to raising the loan rate or the Treasury’s borrowing rate.”

So, the Central Bank can certainly hike the loan rate or the Treasury’s borrowing rate. It happened after the Central Bank cut the policy rate by five points in the September – December 2021 period. In short, it is all about the policy rate. The ‘interest rate’ in the title of Murat Yetkin’s article is actually the policy rate.

Is it possible to predict if the Central Bank hikes the policy rate?

It would be odd to say ‘I do not know’ after all arguments mentioned above. Unfortunately, I do not know, we do not know, I cannot predict, we cannot predict…

Here is the issue: The main reason that promoted us to be the leader in the inflation league is that the policy rate cut by five points to 14% when inflation had already been high (but we were not the leader yet), and “do not worry; the exchange rate would increase; Turkey’s competitiveness would increase, we would export more, we would have a current account surplus instead of a current account deficit; consequently the exchange rate would start to decrease, inflation would decrease” was a masterpiece analysis.

Thus, how is it possible to look from a “rational” window and predict what the Central Bank will do?

Moreover, inflation set sail towards 70%. Even the most optimistic forecast for the end of the year is around 40%. So what? Will the Central Bank raise the policy rate from 14% to 40%?

For instance, let the Central Bank set the policy rate as 19% or 21%. On the one hand, it would mean a big jump. On the other hand, would it not be dramatically low considering the level of inflation that could occur? A complete dilemma… Moreover, the issues we have been through cannot be simply solved by increasing the policy rate. So, what are other policies? We have not yet been informed about any of them.