Turkey is set to hold elections on May 14. Country’s current president and the ruling Justice and Development Party (AKP) leader Tayyip Erdoğan has been using the “election economy,” making populist promises for attracting votes in this critical turn. Turkish economy, on the other hand, is more fragile to handle such promises.

In the pre-election period, it is customary for the ruling parties to turn on the populist taps and “revitalize” the economy. However, in order to do this, you need funding to flow when you turn on the faucet. If the resources have dried up, it is possible to enter the May 14 elections with a very different picture.

So, what is that picture?

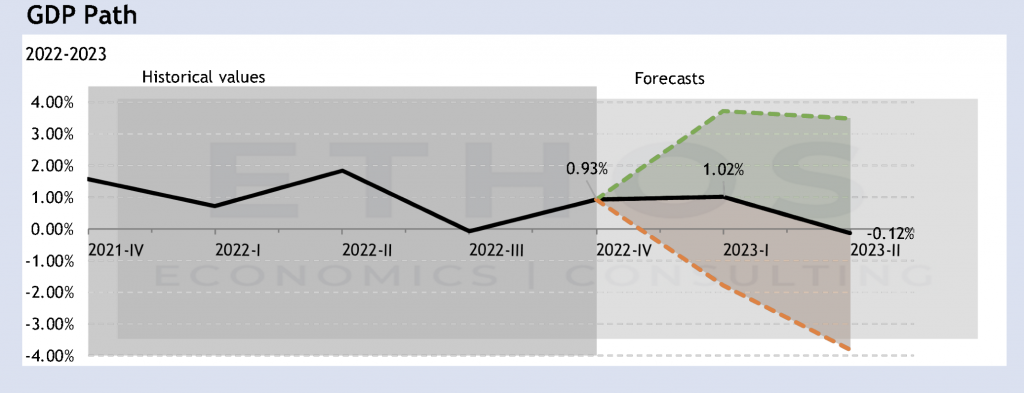

The figure shows our quarterly growth forecasts with Cem Çakmaklı and Sevcan Yeşiltaş from Koç University. In the light of the latest data, we observe the following dynamics:

- In the first quarter of 2023, we expect a growth rate of around 1 percent compared to the previous quarter. This is due to the cumulative effects of interest rate cuts, demand pulled forward by inflation expectations, and all the populist policies put in place before the elections, such as the minimum wage hike and the increase in government spending. This figure corresponds to an annualized growth rate of 3.7 percent compared to the same period of the previous year.

- In the second quarter of 2023, we expect the growth momentum to decelerate further and come to a stall, compared to the previous quarter. This corresponds to an annual growth rate of 1.7 percent. What lies behind the economy’s loss of momentum? We can list factors such as the gradual decline in spending that was brought forward in anticipation of inflation, the erosion of purchasing power in the face of inflation, the adverse impact of the appreciation in the real exchange rate on exports, and the credit tightening.

It seems that the resources are drying up and there is no room for a new doping that we have seen in the past, in every slowdown.

Why didn’t low rates bring high growth?

We are facing a rather dim growth outlook right before the elections, which would not be the intended outcome of government policies. What went wrong? Shouldn’t low interest rates be supposed to bring higher investment, growth, and employment?

The answer to this question is clear: It is true that interest rates are the cost of borrowing. But in order to lower the policy rate and stimulate growth, you need to lower interest rates without fueling inflation.

So, let us look for an answer to this question:

What happens if inflation increases when you lower the policy rate?

- Since inflation reduces purchasing power, inflation drags down the demand that was boosted by low-interest rates

- The local currency depreciates in proportion to the inflation gap between Turkey, say, the US. An increase in the exchange rate increases production costs. If you try to suppress the exchange rate, this time the real exchange rate increases, and exports are negatively affected

- Market interest rates increase in line with inflation (we saw this in the first half of 2022)

- You can lower the market interest rate through financial repression (this is what we have been experiencing since the second half of 2022). However, in an environment of high inflation and suppression of the free market, factors that hinder investment appetite come into play. Low-interest rates are not the only determinant of investment. Economic foresight, stability, and credibility are important. If you reduce economic foresight while lowering interest rates, the two effects offset each other’s impact on investment.

What is the net impact? Let’s look at the data.

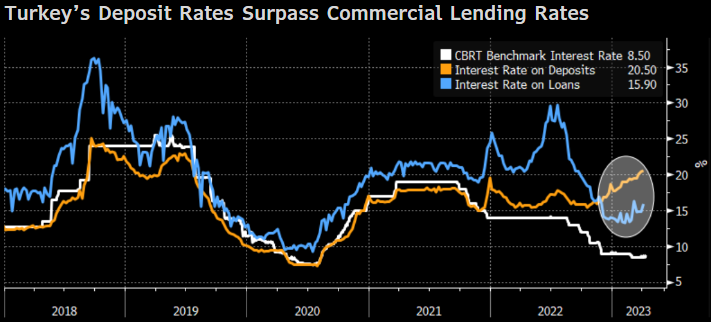

Turkey’s Deposit Rates Surpass Commercial Lending Rates. Graphic: Twitter/Selva Baziki @SelvaBaziki

The figure is from the presentation I gave at the Second Economic Congress of the Second Century, March 15-21, 2023 in İzmir, titled “Common Misconceptions on the Turkish Economy”. Following periods when interest rates are kept low and inflation and exchange rates are out of control (red line), investment growth (blue column) declines.

What does that mean?

A few messages can be drawn from this relationship:

- In the period before 2022, when the market interest rate was not repressed, periods of low policy rates boosted inflation, not investments. Investors refrained from new investments either due to inflation expectations, depreciation in the exchange rate, or rising market interest rates and uncertainties along with inflation.

- As of the second half of 2022, we have seen that the loan supply started to decrease while market interest rates were repressed. More recently, as banks’ funding costs exceeded their lending costs due to increased regulations, the loan rate, which appeared low on paper, stopped being functional and loan growth came to a halt.

- In both (1) and (2), the underlying economic dynamics point to what I have long described as “contractionary expansion”. In other words, lowering the policy rate by ignoring the underlying inflation problem may look like an expansionary step on paper, but it ultimately has a contractionary effect on the economy.

What has changed?

Did the dynamics that slow down the economy after an increase in inflation not exist in the past, but have come into play now? If inflation suppresses growth, how come we grew 5.6 percent last year? These effects were present in the past, but when the short-term benefits of interest rate cuts were exhausted and their side effects began to kick in, a new round of easings were introduced.

When inflation increased and reduced purchasing power, another round of interest rate cuts was introduced to stimulate consumption.

If the low-interest rate environment increased the demand for foreign currency, the demand was curbed with the exchange rate protected deposit instrument, the cost of which was borne by the public sector (and estimated to be 180 billion TL). If that was not enough, the Central Bank’s foreign exchange reserves were sold (Bloomberg’s Selva Baziki calculates that this figure has exceeded $128 billion since December 2021). When none of that was sufficient, this time they tried to control the demand for foreign currency by tightening credit standards.

At this point, we have come full circle. We started this journey with the aim of lowering interest rates and increasing bank loans to promote growth. Yet at the end of the road, we reached tightening in credit and a slowdown in growth. What we are left with is a rather low but pretty unfunctional policy rate and the resources depleted for this purpose.

2023 scenarios for the Turkish economy: Pre-election, post-election