The Central Bank of the Republic of Turkey (CBRT) Governor Fatih Karahan, appearing before the press for the first time following the contentious dismissal of the previous Governor Hafize Gaye Erkan, announced the first inflation report for the year 2024. (Photo: T24)

The Central Bank of the Republic of Turkey (CBRT) Governor Fatih Karahan, facing the cameras for the first time following the contentious dismissal of the previous Governor Hafize Gaye Erkan from office, announced the first inflation report for the year 2024.

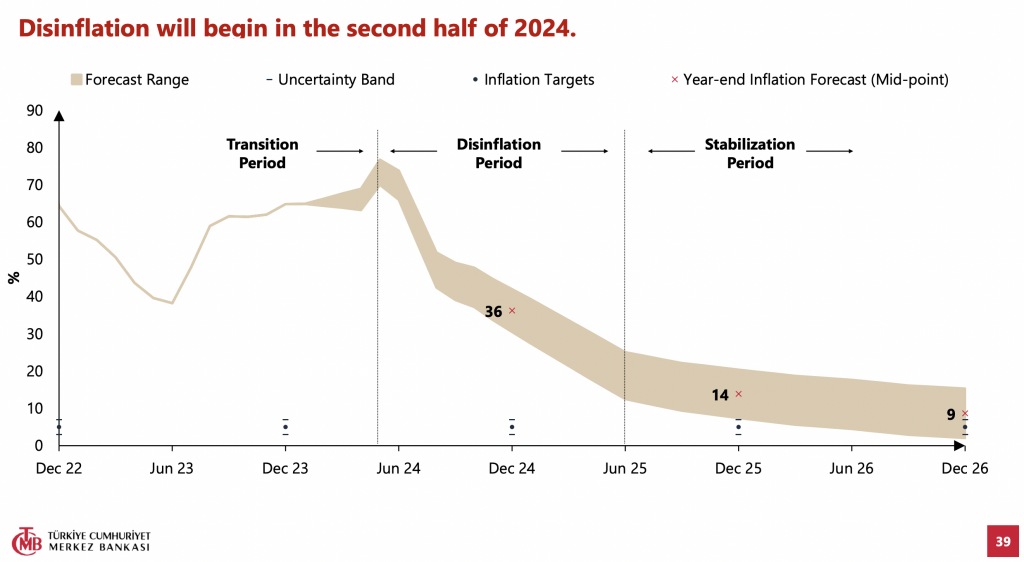

Speaking at a press conference on February 8, Karahan stated that the inflation forecasts for the end of 2024, 2025, and 2026 remained unchanged from the previous report, with an estimate of 36 percent at the end of 2024 and 14 percent at the end of 2025.

Karahan, appearing before the press for the first time since taking office, emphasized during his presentation that inflation would peak in May, and disinflation would begin in the second half of 2024, with average monthly inflation dropping to around 1.5% in the last quarter of the year.

“Inflation is projected to be 36 percent at the end of 2024, and fall to 14 percent at the end of 2025. Consumer inflation was 64.8 percent in 2023, close to our forecast of 65 percent in the previous reporting period,” the report read.

“Medium-term forecasts are based on an outlook that CBRT’s tight monetary stance, which reflects the CBRT’s commitment to intermediate targets, affects price-setting behavior via monetary transmission channels. Under this monetary stance, previous Report’s year-end forecasts are maintained. Balancing factors were effective in maintaining the year-end forecasts.”

Inflation, monetary tightness, policy rates

In his presentation, Karahan emphasized that efforts would continue to establish disinflation, stating, “We are determined to maintain monetary tightness until we reach levels consistent with our inflation targets. We closely monitor inflation expectations and pricing behaviors. We will absolutely not allow any deterioration in the inflation outlook.”

“We will continue our efforts to bring down inflation to the path we have predicted, maintaining our policy stance until we achieve lasting price stability in the medium term. The timing and pace of interest rate cuts in the coming period have become important globally. It is evaluated that Central Banks will continue their easing processes gradually, and monetary tightness will be maintained globally,” he said.

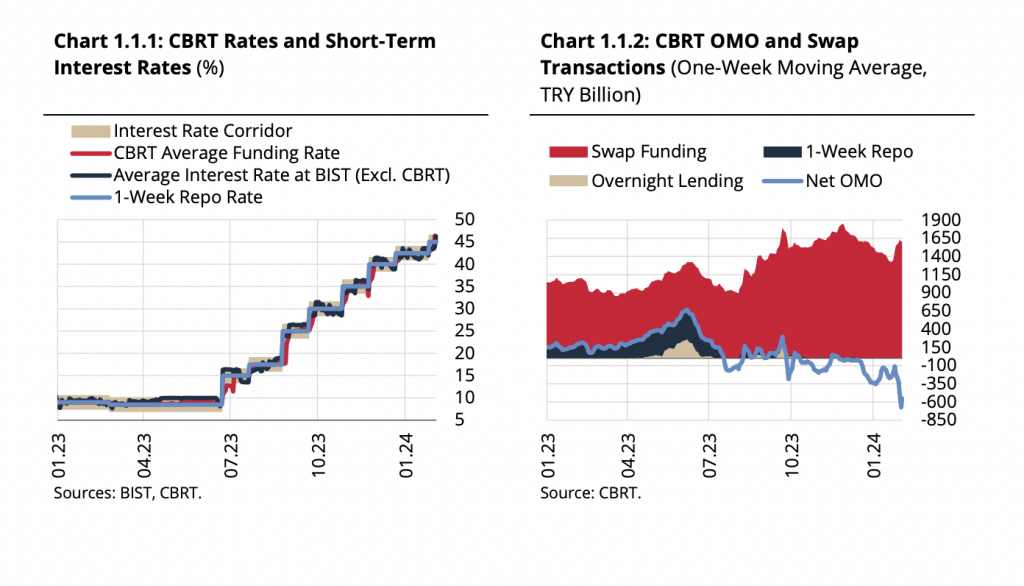

Karahan noted that the current level of the policy rate would be sustained, saying, “There are two main conditions. The first is the clear decrease in the main trend of monthly inflation. The second is the convergence of inflation expectations to the projected forecast range. With the level the policy rate reached in January and the supportive steps we have taken, we have reached the necessary monetary tightness for the establishment of disinflation.”

Central Bank of the Republic of Türkiye (CBRT) Monetary Policy Committee’s (MPC) raised the one-week repo rate, known as the policy rate, to 45 percent on January 25, adding that it will maintain the level “as long as needed”.

The bank has lifted its one-week repo rate by 3,650 basis points since June, when President Tayyip Erdogan appointed former U.S. banker Hafize Gaye Erkan as ithe governor to conduct a sharp pivot toward more orthodox policies.

Erkan’s removal from office stirred debate on any shift in orthodox policies. Responding the concerns, Minister of Finance Mehmet Şimşek stated that the policies framed by the Medium-Term Program will be implemented without any obstacle.

CBRT governor faces backlash over family interference claims