Selva Demiralp is a professor of Economics at Koç University, Istanbul.

selvademiralp.com

The government revealed its new economic program for 2021-2023 on Sept. 29. The long-term goals of such programs hardly go beyond being a wish list worldwide. This is because the economy is an equation with so many unknowns. Hence, it can even be difficult to predict the following month not to mention the following year.But

1. Low interest-high growth proved unsustainable The first week of September was rather intense in terms of data releases. The growth numbers that were released on August 31 reflected an 11 percent decline compared to the previous quarter. This number is rather close to the OECD average. If we express the Q2 growth in annualized

Following the exchange rate crisis in August 2018, Turkey is shaken by yet another exchange rate shock. How did we get here, and why? Economists have been discussing these questions for a long while. As we look at the big picture, we could see the widening gap between what should be done and what was

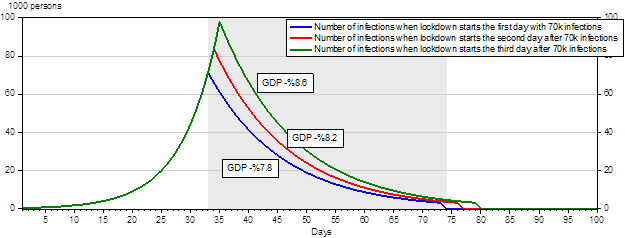

Turkey implemented a partial lockdown to contain the COVID-19 outbreak. These limited measures, which kept majority of businesses open, which kept majority of businesses open, managed to avoid more adverse outcomes that could have been expected. Could Turkey have done better in those three months? Yes, we probably could have. If stricter measures were put

Let’s evaluate the last two months of our COVID-19 experience.Turkey started with immediate partial lockdown measures which were enhanced over the course of the pandemic. Schools were closed in mid-March and the businesses were encouraged to work remotely where possible. The elderly and the youth, who constitute about 40 percent of the population are under

In the inflation report that came on April 30, Turkish Central Bank (CBRT) revised its inflation forecast for 2020 from 8.2 percent to 7.4 percent. The forecast for 2021 is kept constant at 5.4 percent.How realistic is this revision? In the short run, the downfall in demand and the fall in oil prices may dominate

In my earlier piece, I had mentioned our ongoing research that investigates the economic costs of delaying a full lockdown . In this piece, I would like to share the preliminary results from that research that explores the effects of COVID-19 on the Turkish economy and proposes policy recommendations. In addition to myself, the research

We all know that Covid-19 is a humanitarian problem, and containing the pandemic as soon as possible is an urgent obligation to save human lives.From an economic perspective, the total cost of containing the pandemic immediately is less than that of isolation policies that are put into delayed practice.The economics profession unanimously agrees that the

Coordination among monetary and fiscal policies is needed much more than ever at this time. While both of these policies aim to provide economic stability, their tools and areas of operation are different. It is essential for these policies to complement each other and support the economy without generating additional risks and vulnerabilities. Monetary Policy

The Federal Reserve has had another emergency meeting, the second within the last fortnight. On March 15, they cut the policy rate by 100 basis points and brought it to the zero-lower bound. In addition, they re-started large scale asset purchases which had ended in October 2014. They lowered the reserve requirements to support loan