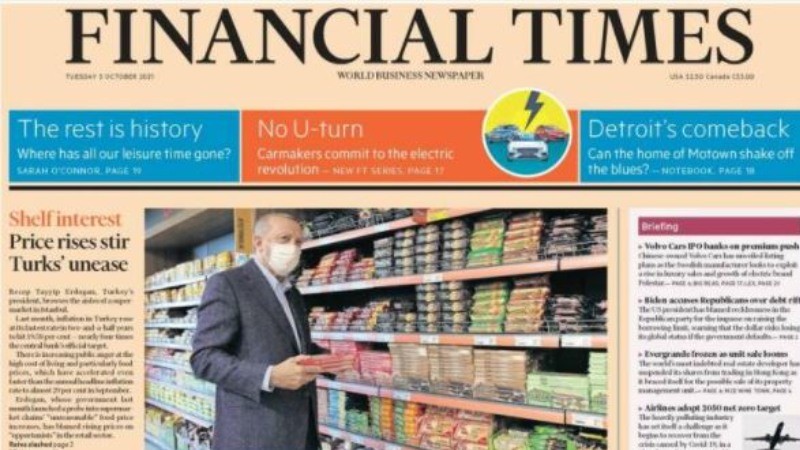

Different inflation values are flying around in Turkey. If you look at the consumer price index of the Turkish Statistical Institute (Turkstat), which should be of interest to the average citizen, annual inflation is 19.6 percent. Yet, a growing number of citizens think that inflation is much higher, mainly because of increasing prices. There is an index that supports this idea. According to the Inflation Research Group, consumer inflation is much higher: 44.7 percent.

There are also “core” inflation indicators which filter out temporary developments and find the underlying inflation trend. Inflation measured by the C indicator, excluding energy, food products, soft and alcoholic beverages, tobacco products, and gold, among the six core price indicators of Turkstat, is at 17 percent. The remaining five indicators point to inflation above 18 percent. The highest is 20.8 percent. I know you are tired of numbers but bear with me. There is also a domestic producer price index that aims to measure the developments in producer prices. Since it contains producer goods such as iron, sheet metal, fertilizer, it does not concern the consumer directly.

Still, the developments in this index are ultimately reflected in consumer prices to a greater or lesser extent. According to this index, (producer) inflation is at the level of 44 percent.

The “exorbitant prices” row

These inflation figures are pretty high compared to other countries and Turkey’s 2004-2016 period. The fact that the inflation experienced by the average citizen in recent months is much higher brings complaints about the “exorbitant” price increases. Almost everyone, from the average citizen to the President, wants to fight against exorbitant prices.

Let me leave the “exorbitant” part aside and focus on the fight against inflation—no need to delve deep into economic theory. Turkey’s experience after the 2001 crisis is well known. When the exchange rate regime implemented between January 2000 and February 2001 collapsed towards the end of February, the exchange rate soared, along with inflation. By January 2002, consumer inflation was 73 percent. To address enormous problems accumulated in the aftermath of the crisis, “Turkey’s Transition to a Strong Economy Program” was put into practice in mid-May 2001. First, a tight fiscal policy was put into effect to reduce the budget deficit and public debt, which were very high at that time. Secondly, decisions were announced that would first resuscitate the seriously damaged banking sector and gradually get it back on its feet. Transparency regarding public finance and the banking sector has increased tremendously. Third, the law of the Central Bank of Turkey (CBRT) was changed: extending loans to the Treasury was prohibited. The dismissals of senior executives were made extremely difficult, and their terms of office were extended.

The formula that worked well in the past

The primary purpose of the CBRT was to ensure price stability. With this goal, it is indicated in the law that the bank can use the tools specified in the law as it wishes. In short, the CBRT was made independent. Tender law has been rewritten from scratch. Agricultural support policy has been changed.

The main framework of this program was implemented with some minor changes until the beginning of 2007-2008. Inflation fell to 8.4 percent at the end of 2007. On the other hand, the average growth in the 2002-2007 period was 6.8 percent. In other words, growth was also strikingly high when inflation fell dramatically; moreover, private investment expenditures were also increased significantly. Public debt followed a downward trend. Interest rates too. The share of foreign currency deposits in total deposits gradually decreased, dollarization was out of the question. Turkey’s risk premium (CDS) fell as low as 135 (mid-2006). It should not be forgotten that fields other than the economy also significantly contributed to achieving these positive results. The positive impact of the accession process to the European Union (EU) should also be noted.

Dollarization, inflation, and risk premium

Let us briefly compare today with that period in terms of the elements I have mentioned. Our public debt is now much lower than it was at the beginning of that period. The banking sector is still in a better state than at the beginning of that period. Unfortunately, that is all of the positives.

The CBRT is no longer independent. It is unclear what is intended to achieve with monetary policy, let alone if it cares about inflation. There is a transparency problem in some areas of public finance. For example, what is the exact size of the Treasury’s income and debt guarantees? How much of a burden is the budget in an unfavorable scenario? How did the “crazy” credit boom of 2018-2020 affect the banking sector? To what extent would a possible negative external shock increase the non-performing loan problem?

The EU accession process is stalled. There are considerable problems in foreign policy. The liabilities in foreign currency of non-financial companies have decreased compared to 2018; however, still high. Hence, their balance sheets are fragile and have limited capacity to withstand any exchange rate shocks.

Problems are solvable but not this way

Overall, inflation is high; growth is volatile and low on average. Unemployment hits high levels. Dollarization is rising again. Our risk premium (CDS) rose over 400.

All in all, there are significant problems; nonetheless, these are solvable problems. In my article of September 21. I discussed the rough outline of an economic program that could ease these problems. The framework I drew included what to do to reduce inflation. In that context, there was no opening of “regulation sales stores“. Or the “price determination” committees of the pre-1980s. Regardless of them, we can hit the road by making the CBRT independent again, for instance.