Consumer inflation in March was announced as 61.1 percent. Thus, we went back twenty years. The last time inflation was above this level was in March 2002: 65.1 percent.

Nonetheless, there was a significant dissimilarity. At that time, the “Transition to a Strong Economy Program” was being implemented. The inflation, which had peaked at 73.2 percent at the beginning of the year, already entered a downward trend in March. Moreover, it decreased to 29.7 percent by the end of 2002 and 18.4 percent in 2003. Conversely, we have not seen the peak yet. Inflation will rise for at least a few more months. It will most likely reach 70 percent, that is, if the exchange rate will not move upwards.

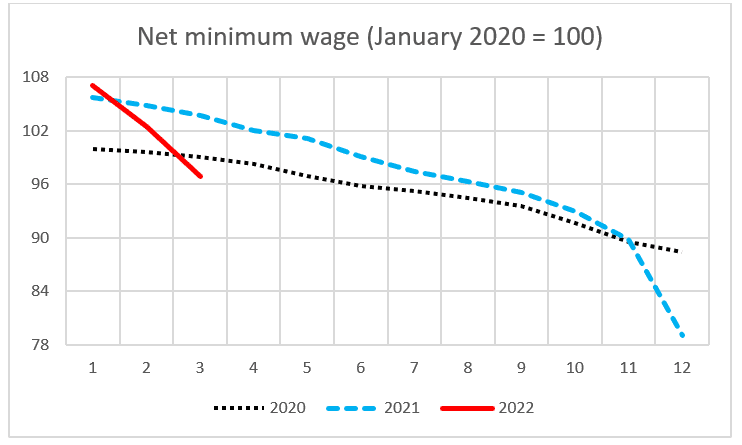

The real minimum wage fell 6 percent

Indeed, inflation hits those with low income and the unemployed first. The severity of this blow is better understood when the minimum wage is adjusted for inflation. The minimum wage was raised significantly in January. Nevertheless, the inflation-adjusted (real) net minimum wage fell below its level a year ago in February. In March, it fell below its level in 2021, and its level in 2020. Yes, the net minimum wage is now 2.3 percent lower than two years ago and 6.6 percent lower than a year ago (Graph 1).

Monetary policy is in a stalemate

Rising inflation also deals a blow to monetary policy. The policy rate was 19 percent in September last year, and consumer inflation was 19.6 percent. If the policy rate were raised by a few points at the September meeting, and if it were signaled that this rise would continue in October, it could have been possible to reverse inflation, for example, directing it below 15 percent. Even when the inflationary effect of the Russo-Ukrainian war would push inflation up a few points, we could have kept it below 20 percent. That would be high inflation; even so, it would be well below the current level at least.

Moreover, monetary policy would not be in a tight corner as it is now. What is this corner? Assume you aim to fight inflation seriously. You should align the policy rate with expected inflation for at least twelve months ahead. Let us take March 2023 inflation as 35-40 percent with the most optimistic forecast. In this case, will the policy rate, which is currently 14 percent, be increased to 40 percent? Would not that be a complete shock?

The credibility of the inflation forecasts

That is what I mean by “corner.” Moreover, the policy rate I have indicated is valid if the forecast for the inflation of the next twelve months is trustworthy. It would be a great shame if no one believes the forecast for twelve months ahead; increasing the policy rate to 40 percent would not work either.

Thus, the third blow of inflation emerges. Once created to combat inflation (before the explicit inflation targeting in the 2001-2005 period), the tools are falling into disrepute one by one.

Central banks announce inflation forecasts. If the declaring central bank is a reputable central bank, that forecast acts as a guiding light in the fog. It shows the way since it gives a reliable scheme about future inflation to those who will sign contracts regarding the future.

In the Inflation Report published on October 28, 2021, the CBRT’s inflation forecasts are as follows: 18.4 percent for the end of 2021 (for two months ahead) and 11.8 percent for the end of 2022 (for fourteen months ahead). However, at the end of 2021, inflation was 36.1 percent. Hence, I cannot articulate my thoughts on the 11.8 percent forecast for the end of 2022.

The credibility of the policy rate

The policy rate is the most vital tool of central banks in their fights against inflation. Mr. Nebati, the Minister of Treasury and Finance himself, downplayed this extremely valuable tool. In a statement he made in January, he said, “Policy rate does not matter anymore; we have decommissioned it.”

In his speech on April 4, the Minister said this time: Inflation is currently over 60 percent; it is a problem. However, we also detached it from the clamps of interest rate. No investor, entrepreneur, or capital in this country uses an interest rate above inflation.”

An unfortunate statement. Those familiar with the economics literature in which causes of inflation and methods of fighting inflation are analyzed are also aware of how significant that “clamp” is. Because that “clamp” has a name in the literature: It is called an anchor. If inflation was a ship, you would anchor it so that it does not head to the open sea; waters where high inflation prevails. That anchor is the policy rate anchor. If there is no clamp (no anchor), the situation is dire. While you think you are in a safe bay at night and fall asleep, you wake up in the morning to find out that you are in the open sea. God forbid…

Yet, that is not how the story started

There was a general election on November 3, 2002. Before the election, consumer inflation had fallen to 37 percent. Then the AKP period began. In the first years of the period, inflation continued its downward trend. In February 2004, it reached single digits with 9.5 percent. The average annual consumer inflation for January 2004-December 2016 was 8.3 percent.

What happens next is well-known. Until the pandemic outbreak in Turkey, from January 2017 to February 2020, there was single-digit inflation for only four months, and that was high single-digit inflation. The remainder is in double digits. We have seen out-of-control inflation in the last five- to six-month period.

Undoubtedly, increasing inflation on an international scale has a significant role in this phenomenon. Still, it is not the first time that energy prices and non-energy commodity prices have reached the high values that they both plateaued in February 2022. In the 2011-2014 period, the IMF’s relevant indices and the World Bank point to higher values. However, double-digit inflation was never observed in Turkey at that time.

In short, we are now suffering from all the mistakes we made.