Turkey’s CPI is recorded as 73 percent in official numbers as independent research group calculate 160 percent annual inflation increase.

Turkey’s inflation keeps soaring as Turkish Statistical Institute (TURKSTAT) May calculations indicate a 73 percent increase in annual Consumer Price Index (CPI), while independent inflation research group ENAGroup calculates 160 percent rise.

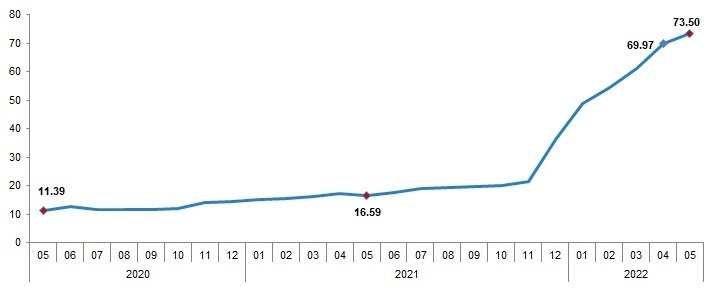

According to TURKSTAT, the CPI increased by 2,98 percent in May 2022, reflected as 73.50 percent in annual increase. The Producer Price Index (D-PPI) increased by 132.16 percent annually.

The independent inflation research group ENAGgroup which calculates inflation with daily consumer data sets indicated that Consumer Price Index (e-CPI) increased by 5.46 percent in May. The last 12-month increase in e-CPI was 160.76 percent.

Annual rate of changes in CPI (percent), May 2022

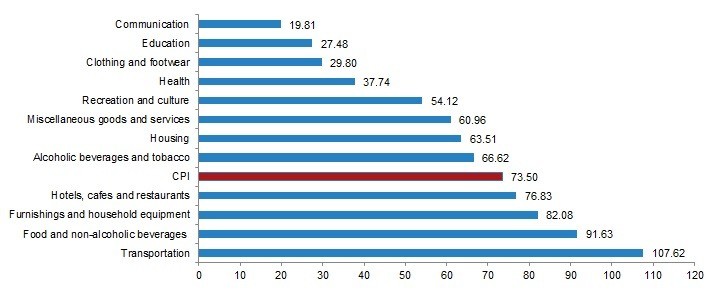

The main groups with the highest increase compared to the same month of the previous year were transportation with 107.62 percent, food and non-alcoholic beverages with 91.63 percent, and household goods with 82.08 percent, respectively.

CPI annual rate of changes in main groups (percent), May 2022

Turkey’s annual inflation surged to a two-decade high of 69 percent in April, fueled by rising energy and commodity prices following last year’s Lira crash.

High Growth vs High Inflation

President Recep Tayyip Erdoğan summoned his top economy policy officials in a closed-door meeting at the presidency on May 31 amid announcements of new price hikes while high inflation keeps straining households.

Turkey recorded 7.3 percent annual economic growth in the first quarter. Data released on May 31 showed a better-than-expected rate amid the currency crisis and high inflation.

Manufacturing and exports were the main pillars of the growth, as Erdoğan strongly defends the current economic policy which prioritizes export-led economic growth with low policy interest rates.

Erdoğan has long been articulating his standing as “interest is the cause, inflation is the result,” while labelling his position as “unorthodox” since CBRT keep rates stable for the last two months despite 69 percent annual growth.

The bank has cut 500 basis points in policy interest rate since last September, which prompted a sustained surge in consumer prices, stoked by Russia-Ukraine War. With CBRT’s independence under question, the Turkish Lira lost around 40 percent in value in a year, followed by the Erdoğan government’s introduction of a new fiscal scheme to keep currency fluctuation under control.

A new program under question?

The “Currency-Protected Deposit” scheme promised Turkish Lira deposit holders treasury-guaranteed compensation from depreciation of Lira against US Dollars.

According to Banking Regulation and Supervision Agency (BDDK), Currency-Protected Turkish Lira Deposit accounts reached 848 billion 870 million Liras in the second week of May. 16 billion 255 million 736 thousand Liras was paid in compensation to these account holders in two months.

After Erdoğan hinted at a possible military operation within Syrian borders in a parliamentary group meeting on May 23, Turkish Lira has once again depreciated against the US Dollar.

A week before, he said Turkey is to block Finland and Sweden’s NATO membership if these two countries “continue their support to terrorists,” referring to the outlawed Kurdistan Worker’s Party (PKK) which is deemed a terrorist organization by Turkey, USA and EU countries. His announcement stirred a diplomatic shuffle in negotations between NATO countries.