The Central Bank of the Turkish Republic’s (CBRT) “fight against inflation cannot be considered very successful,” the CBRT governor Şahap Kavcıoğlu said on October 27, as the bank raised its inflation forecast by 4,8 percentage points. “We cannot consider (fight against inflation) very successful,” Kavcıoğlu said upon a question from a reporter on October 27,

On September 12, two essential data for July were announced: Labor force and balance of payments. In summary, the situation is like this: The unemployment rate is still at a high level, in particular, the broadly defined unemployment rate is referred to as the ‘underutilized labor rate.’ On the other hand, the current account deficit

The Central Bank of the Republic of Turkey (CBRT) Monetary Policy Committee (PPK) convened on August 18 and lowered the policy rate by 100 basis points from 14 percent to 13 percent. This interest rate cut was a big surprise even for us who are skeptical of various ongoing incredible things in our beautiful country.

The Central Bank of the Turkish Republic (CBRT) lowered the policy rate from 14 percent to 13 percent amid surging inflation and currency crisis. The CBRT decided to lower the long been steady 14 percent policy interest rate to 13 percent after the Monetary Policy Board meeting on Aug. 18. “The Board evaluated that the

The Turkish Lira (TRY) depreciated further against the US Dollar and reached the psychological limit of 18 liras, and closed the day at 17.92 just before the US Federal Reserve announced its interest rate decision on July 27. The last time the US Dollar TRY parity passed the 18 limit was on December 18 2021

Medics’ strike to mark violence against health workers continues in its second day after the police attack in İstanbul in the first day sparked outrage; Erdoğan addressed citizens asking for patience about economic difficulties; İsrael-Türkiye signed an outline of civil aviation agreement; disputed cargo ship sailed to Russia, Ukraine summoned Turkish envoy; far-right party leader

High inflation and increasing poverty have become our most significant economic issues. Consumer inflation in June is 78.6 percent, food inflation is 93 percent, and producer inflation is 138.3 percent. The 2022 inflation rate under President Recep Tayyip Erdoğan’s rule has exceeded the inflation rate of former Prime Minister Bülent Ecevit’s term in 2001, which

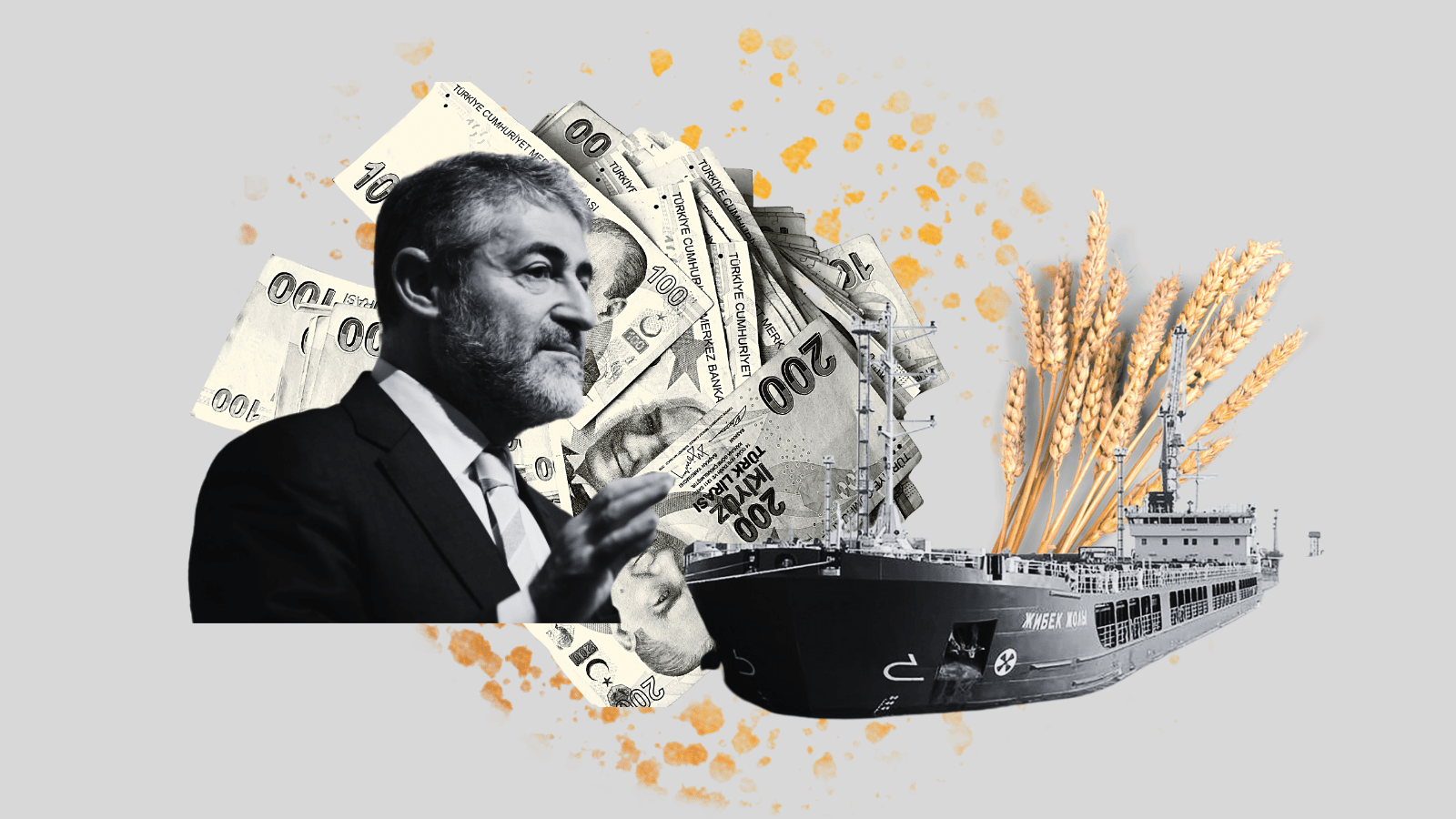

Türkiye’s inflation hits a 24-year high of 78 percent, independent researchers argue it is higher, the Minister says the increase is a result of global commodity prices, Foreign Minister reiterates Erdoğan’s warning to Nordic countries in their NATO bid, Russian-flagged vessel carrying grain in Türkiye’s Black Sea port… Here is what you need to know

After a two-day delay, the Banking Regulation and Supervision Agency (BRSA) announced the rationale and the implementation methods for its Decision numbered 10250 (‘Decision’ from now on), taken on June 24 and caused great controversy; including about loans and rates. The statement made on June 26 sets out the reasoning for the Decision. Trying to

Erdoğan attends İsmailaga Community leader’s funeral, Senior UK Ministers and İsraeli Prime Minister in Ankara, Policy interest rate stays the same, Council of State case over İstanbul Convention, Turkish public discuss on mini-documentary on sex workers… Here is what you need to know what is going on in Turkey Today: 1- Mahmut Ustaosmanoğlu, the leader